As a perfumer with over a decade of experience in the daily chemical fragrance industry, I deeply understand that the selection of fabric softener sheet fragrance directly determines a product’s market competitiveness. This type of fragrance is not just a simple scent carrier; it needs to balance thermal stability, fragrance longevity and fabric compatibility, while aligning with global consumption trends. Below is a professional breakdown of core selection points and market trends for 2024-2025.

I. Four Core Selection Principles for Fabric Softener Sheet Fragrance

The unique “drying-fragrance retention” scenario of fabric softener sheets imposes three exclusive requirements on fragrances, which are also the core considerations in developing Gar Aromas’ fabric softener sheet fragrance:

-

Thermal Stability as Priority: Drying temperatures can reach 120-150℃, and low-quality fragrances tend to volatilize or produce odors. High-quality fragrances must pass high-temperature resistance tests. For example, our product undergoes 150℃ continuous testing for 30 minutes, with a fragrance retention rate of over 90%, compatible with mainstream drying equipment processes.

-

Fragrance Longevity Layer Design: Consumers care about both “instant fragrance after drying” and “slow release during wearing”. Perfumery requires a structure of “fresh top note activation – stable middle note retention – skin-friendly base note release”. Our citrus fragrance, for instance, uses limonene as top note, irone as middle note and muscone as base note, achieving 72-hour continuous fragrance.

-

Non-Negotiable Compliance: European and American markets have strict restrictions on VOC (Volatile Organic Compounds) content in fabric fragrances, and the REACH regulation has updated its 2024 prohibited ingredient list. It is essential to confirm complete MSDS/TDS reports when selecting. Our products have passed both REACH and FDA certifications, enabling direct access to European and American supermarket channels.

-

Substrate Compatibility: Cationic surfactants in softener sheets easily react with fragrance components, causing scent distortion. Fragrance molecules with strong hydrophilicity should be selected. We optimize fragrance solubility through emulsification technology, achieving perfect compatibility with softener sheet substrates of mainstream brands like P&G and Unilever.

II. 2024-2025 Market Trends & Leading Brand Movements

The global fabric softener sheet market grows at an annual rate of 8.3%, with fragrance trends showing three characteristics: “naturalization, functionalization, and regionalization”. The layout of leading brands is highly instructive:

1. Scent Trends: From “Single Note” to “Scenario-Based Complex Scent”

-

Natural Plant Extracts as Mainstream: Givaudan’s “White Tea & Cedar” scent for Comfort and IFF’s “Green Apple & Basil” scent for Downy both use natural plant extracts as core components. Such fragrances account for over 60% of the European and American markets. Our “Bamboo Forest After Rain” and “Citrus Orchard Morning” series are developed in response to this trend.

-

Rise of Functional Scents: Fragrances labeled “soothing for sleep” and “refreshing” are growing significantly. Firmenich’s “Lavender + Chamomile” scent developed for Febreze softener sheets adds linalool (a sleep-aiding ingredient), with a premium rate of 30%. Our “Sleep-Enhancing Cedar” variant has also passed third-party sleep laboratory verification.

-

Return of Retro Woody Notes: The retro trend in the North American market has driven the recovery of woody scents like sandalwood and pine needle. Coty’s “Smoked Sandalwood” scent for Gain doubled its sales within six months of launch.

2. Regional Preferences: Accurately Matching Regional Consumption Habits

European and American markets prefer fresh cool notes (e.g., mint, ocean), Southeast Asia favors rich floral and fruity scents (mango, frangipani), while the Middle East prefers rich scents like amber and musk. Our “Tropical Fruit Basket” fragrance customized for Southeast Asian clients has achieved a 15% market share in Indonesia and Thailand.

3. Insights from Leading Brands’ Fragrance Strategies

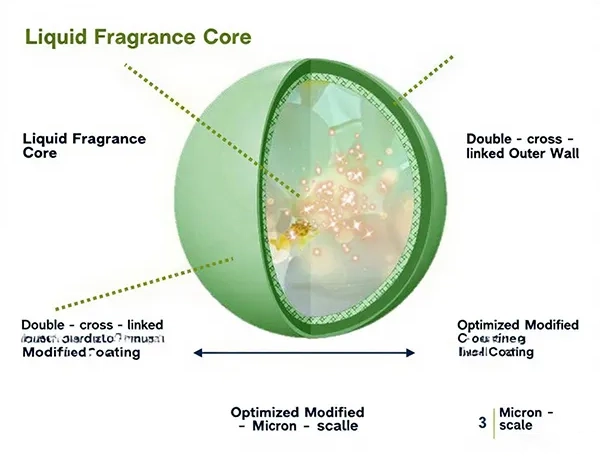

Downy’s selling point of “7-day fragrance retention” lies in its fragrance microcapsule technology; Lenor maintains freshness through “seasonal limited scents” such as spring cherry blossom and winter pine needle variants. Local brands need to break through in “exclusive customization”. Our “small-batch customization + rapid sampling” service for small and medium-sized OEM clients lowers the threshold for following trends.

Selecting fabric softener sheet fragrance essentially balances “technical adaptability” and “market insight”. As a perfumer, I have always believed that a good fragrance is not just a scent transmitter, but an emotional link between brands and consumers. Gar Aromas is ready to leverage its professional perfumery capabilities to help your products stand out in the global market.